The Hong Kong-Shanghai Connect has finally started.

This is a very, very significant step in

the reform process that China has started, and as outlined in 2013 during

the Third Plenum (please see our China Compass of both March and May 2014), this is an important puzzle piece in the whole financial reform and

liberalization process: a PRC stock exchange has opened up to the world.

Non PRC investors (not only Hong Kong residents but all

overseas investors) are now able to directly buy shares listed on the Shanghai

stock exchange, (“northbound”), and qualified PRC investors (individual

investors with a minimum of RMB 500k in their accounts, in other words the

better off) are able to invest in HK listed stocks (“southbound”), (including of

course the international firms that have used HK as a listing exchange, who

will now benefit from a huge potential new investor base).

There are exceptions in both directions, such as shares not

traded in RMB in Shanghai (so called “B” shares) or not traded in HKD in Hong

Kong, or Hong Kong shares with a dual listing in another Chinese city than

Shanghai.

Also the Hong Kong Shanghai Connect does not work for IPO’s;

international investors can continue to participate in HK IPO’s, but not in

Shanghai as yet. Similarly the Chinese investors in Hong Kong IPO’s cannot use

the Connect for this purpose. This is bound to change over time.

Nevertheless the two exchanges become so closely

intertwined, that this is clearly the first step of a long process through

which ultimately One China Exchange

will be created. Already there is talk of a future addition of Shenzhen to this

couple, creating a really powerful threesome.

Already the new “virtual” HK-Shanghai combination becomes

the 2nd largest stock

exchange globally by capitalisation, and 3rd largest by turnover.

Focusing first on the northbound traffic into Shanghai:

Suddenly 985 Chinese companies (855 that did not have a dual

listing with HK), become accessible to the global investment community. This

will increase the global investment focus on the top companies in this group,

which will slowly but surely have a positive impact on transparency. The global

investor focus on China will increase, and evolve from just macroeconomics to

specific company analysis. (Knowledge of Putonghua and a real understanding of

China will be a plus!)

There is also a deeper agenda; many SOE’s have listed

subsidiaries in Shanghai. International investors will over time force the SOE’s

to act increasingly like the private sector, which fits perfectly with the

Governments agenda to stimulate SOE reform.

Remember that the new mantra is that “market forces will play a decisive role in the allocation of all

resources”, which includes capital, and includes SOE’s. Similarly the Government is looking for private investment

in the public SOE’s, in order to assist them to reform. The Connect is a

backdoor into some SOE’s.

With regard to the southbound traffic:

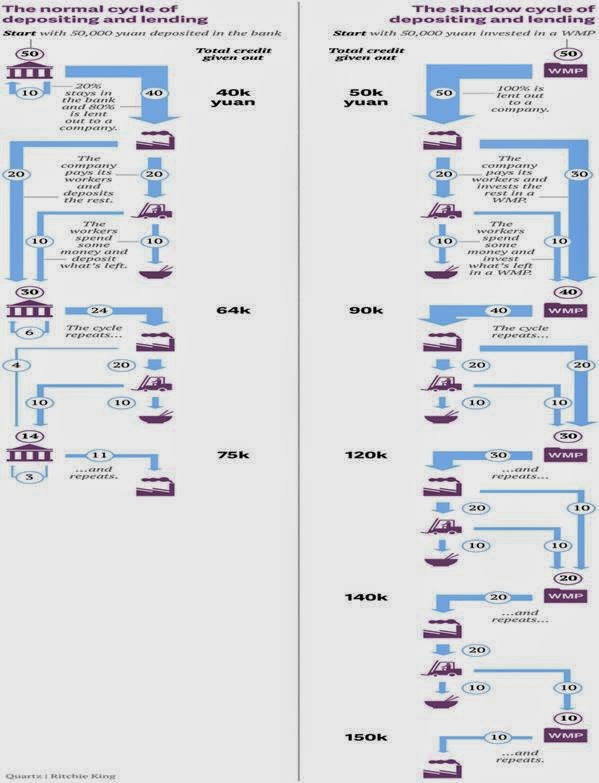

Chinese investors have had limited opportunities to

(legally) invest their funds; hence the real estate prices, the success of Yu E

Bao (Alibaba’s savings account), and the wealth management products linked to

shadow banking.

We believe the demand for diversification is very strong, (driven

also by a very high savings quotient) and therefore the chance to invest in

Hong Kong stocks that are not also listed in China, or even sectors that are

not available through the Chinese exchanges, will be taken up with huge eagerness.

Other issues that will logically materialise:

The purpose of Chinese companies having dual listings SH-HK mostly

falls away. This is bound to have a longer term negative impact for Hong Kong, as

Hong Kong was also the PRC company’s window to the west. The Shanghai listed

PRC companies will over time likely opt to focus on Shanghai, and delist their

HK shares, as currency exchange regulations also liberalise.

On the other hand however, Hong Kong does become more

important as a listing exchange for international companies seeking exposure to

Chinese investors.

All in all exciting times. The Connect is but another step forward on the reform path, albeit a huge leap for Chinese financial reform.

Daniel P. de Blocq van Schetlinga

Polarwide Ltd.

.jpg)